Saturday was a special day for Hong Kong: the South China Morning Post carried veteran business reporter Enoch Yiu’s 1,000th adoring feature on all-purpose establishment worthy Ronald Arculli. And to celebrate, they decided to call him ‘Robert’ in the intro. Perhaps the idea was to make him sound less like ‘cold warrior’ US President Reagan and more like that great friend of China, Zimbabwean President Mugabe. I cannot think of any other explanation.

Saturday was a special day for Hong Kong: the South China Morning Post carried veteran business reporter Enoch Yiu’s 1,000th adoring feature on all-purpose establishment worthy Ronald Arculli. And to celebrate, they decided to call him ‘Robert’ in the intro. Perhaps the idea was to make him sound less like ‘cold warrior’ US President Reagan and more like that great friend of China, Zimbabwean President Mugabe. I cannot think of any other explanation.

All this excitement sadly detracted from an even more enticing story in the main news bit of the paper. It was all about the Hong Kong government’s decision to slap extra stamp duty on property transactions in a belated attempt to stop the current bubble from further inflating. The measures will dampen market activity, leading one industry insider to predict that real estate agents will be made destitute and forced to claim welfare in order to avoid starvation. Such a prospect would, presumably, be accompanied by the disappearance of street-front rows of identical property agencies, freeing up space for hair salons, stationers, noodle shops and other retailers who actually do things that benefit the economy and society. Indeed, after encountering the first corpse of an emaciated property intermediary I find, and prodding it with a stick to make doubly sure, I think I will recommend Financial Secretary John Tsang for a special diamond-encrusted Platinum Bauhinia Star.

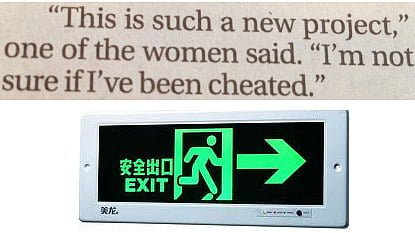

Whether the additional levies make any economic sense or have any chance of making homes more affordable is a different thing altogether. That we are already well into bubble territory must be clear from the recent parking space mania and the bizarre sale of individual suites at Cheung Kong’s Apex Horizon project. Recent jitters in the stock market at the merest hint of tighter Federal Reserve policy should have warier property investors looking around for the ’emergency exit’ signs. One sign that a crash is on the way is when the forlorn, the naïve, the copycats, the left-behind and the plain pitifully ignorant start to clamber on to the bandwagon. They are the last to turn up, and the least able to afford financial losses. The SCMP today quotes what would appear to be one who has bought a unit at Li Ka-shing’s exotic Kwai Chung hotel-or-something…

There was silence in the Apex Horizon saloon and even the three-piece Filipino band had turned off their drum machine.

Leung, all in black, entered the swinging doors.

” So what’s it going to be Li? This territory has gotten to be too small for us two. Why don’t you shift your ass to where geriatric billionaires go to eventually. The Kwok ranch in Malaysia sounds a good idea. Or Honolulu. ”

Li, sipping ice-cold Veuve Clicquot at the bar, was polishing his spectacles on a large denomination banknote.

” Take a look at these guns, Leung.”

And he indicated the two pistols in 99.9% Wayfoong gold and rhino horn in the pure dog scrotum holster strapped to his hips.

” One was given to me by Governor Grantham in 1955. The other was handed to me by Deng Xiaoping. I got protection. What do you have?”

Suddenly, the whole edifice shook and the Pepi Hermann crystal glass in Li’s hand crashed to the floor.

From the ceiling there descended a huge leaden slab marked ” Gross weight 5.5 tonnes. Actual Weight 3.5 tonnes” which flattened Li’s body like a jackboot crushing a cockroach.

From BAD DAY AT LION ROCK (unpublished).

I also saw the SCMP reports about 3 x Apex Horizon “investors” reporting to the police that they suspect they may have been cheated by LKS : “I trusted LKS that this would be OK but now the lawyers advice differs from what CK said”

Only suspect ? Ha hahahahahahah

This was a accompanied by a photo of “superman” himself looking more and more like the obnoxious fat Lau of HKY infamy

(They do say that one takes on the physical resemblance of those one lives cheek-by-jowl with, special emphasis on the lower hanging jowl in the case of fat lau and LKS)

As for the impending bubble burst* : “when the amahs get into the market ( and one could also add fools who buy things like Apex Horizons) it’s time to sell ” …. PDQ

*Old Chinese proverb: “Bubble like virginity: one prick all gone”

Its too early in the CY era to judge the man but one thing is certain, Mr. Whiskers, lieutenants from the old Ducky admin (but not equated as dumbwits and newbies like Anthony Cheung) seem more confident under CY to carry out the necessary. At least the guy gives them room to shine and make decisions – good or bad but at least calculated.

HK being HK, if home owners hit negative equity, they will be on the streets protesting why the government didn’t protect them or at least warn them. So for the new wannabie hoteliers, buyers be warned… don’t cry to mama… the mini bonds was a lesson in itself…

People like to throw around the term “bubble”, but such things are actually very rare. So rare, in fact, that the most common example is the Dutch tulip mania from hundreds of years ago (and even that example is probably bollocks).

Is it really irrational for mainland Chinese to fear that their assets (ill-gotten or otherwise) are at risk in China? Is it irrational for them to want to park some of those assets outside China? Is it irrational for them to pay a premium for a property in HK? Is it irrational to believe that the supply of property in HK will fail to adequately meet this demand?

I think the answer to all of these questions is a rather obvious No. This is clearly a market distortion, but it’s quite another thing to say that the people taking part are acting irrationally, which is what “bubble” implies.

I’m still not sensing a full scale crash, panic, abandon ship and let’s run a Harbourfest yet – the printing presses in London, New York are still running and the ludicrously low interest rates are with us for a while yet.

However Hong Kong penchant for investing in silly things continues – Tom.com, Lehman mini bonds, Carparks and now the Apex Hotel Suites –you cannot legislate against stupidity however listening to some of our Legislative Council members it seems they think we should?

Sadly however I think we are all addicted to property here and if it goes what could possibly fill the void? What were those pillars again – tourism …

My personal favourite in today’s SCMP was the story about the ‘Mega Court’ being built in the western part of Sham Shui Po. This is not, as one might suspect, a new shopping mall, but a new judicial facility that will include an XL-size courtroom for high-profile cases that attract a many interested members of the public, and of what passes for the media. A tell-tale sign is that the headline refer to these audiences as ‘ the masses’ who will be ‘packed’ into this Mega Court.

But wait, there is more.

Most of the precious word limit is then allocated to reflect the touching concerns of Law Society vice-president Stephen Hung Wan-shun that public-purse-paid judges and obscenely-highly-paid-anyway barristers would refuse to travel to this exotic location. Yes, ‘refuse.’ No mention of reluctancy, or a hint of irritation about having to inform their drivers of an alteration in their morning commute. They would just ‘refuse’ to go there. It must have something to do with the fact that Robuchon doesn’t deliver to Sham Shui Po.

I suggest we push the envelope a little further on this one, literally. The current proposed location of the Mega Court is a mere three stations away from Hong Kong on the Tung Chung line, and only halfway between Central and Kwai Chung’s Apex Horror-high-rise. Since its construction has only just begun, it is probably not too late yet to amend the plans, and build this elsewhere. Let’s say, oh I dunno, Tap Mun Chau, or perhaps next to the Black Point Power Station. Such a location would provide an excellent opportunity for Messieurs the Honourable Judges to get out of their bubble for once, and see more of the city that feeds them. As for the barristers, I am sure they will find a way to bill their clients for the helicopter ride, they can indeed refuse to go – which would speed up the proceedings considerably.

http://www.scmp.com/news/hong-kong/article/1157743/hong-kong-get-mega-court-pack-masses

Alchemist – minibonds was a lesson that crying to Mama works very well. But now we have a new Mama …

Bela – quite amusing today – time to start your own blog!

Jason

I invented HK blogging, sweedie.

I just do guest appearances now.

@ Mongkok Mzungu

I think that the XL- sized mega court is being built for the day when the ICAC finally the Kwoks and lil’ ole’ Raffy to trial. It will take about 10 -15 years to get them to trial what with all the delaying* tactics they will use , by which time all that will be left to try will be three wizened, dried-up dwarfs ( not unlike what a dead property agent looks like after being hung out for a few days in the sun)

*hence our battle cry should become “delay lo more”

@AC-Tist

And on that day they will all hobble up to the courthouse on the arms of fully uniformed ‘nurses’ to evoke the sympathy of a celebrity struck judge who will exile them to a tennis court in the Caymans or elsewhere. I think I remember that happening before .. but age plays tricks with one’s mind.

I saw that bit of drivel in the SCMToady today about the idiots who bought crap flats at Apex Horizon wondering how badly they’d been fucked while scrambling to blame others for their own inability to understand what they’d bought, and had 2 thoughts:

1) If there’s a clearer sign of a market top than complete retards like these piling into the property market, I’m not sure what it is; and

2) I’ll be disappointed if Big Lychee doesn’t write about this.

Sorry to be a Blog Hog, but a thought. Does anyone know whether this Apex thingy was designed to be a hotel at all? I.e. are there F&B outlets – phones on pabx, central cable TV, central air con, storage rooms, hotel IT systems – or were they just intended to be pokey flats from the get-go? (or perhaps a real el-cheapo hotel with none of the above). Has it functioned as a hotel?

“I invented HK blogging, sweedie.”

Yes. And look how far it’s come since then.

@Jason. Horror of all horrors – yes the sweet mama gave back 100% mini-bond investors. Years of playing equities, we never gripe about losses like when we always like to tell friends how much we make but not the losses. In all fairness, elderly folk were hit and perservance paid off for those who camped outside Citibank in Central.

However, how long does stupidity expect to be covered? Its apparent from the mini-bond saga, HKers are not ready for erotic (ooops, exotic – was thinking of some other stimulant) investment tools that fools dare to venture and devils willing to offer.

I’m not sympathetic to those who are happy to take any upside arising from their ignorance and not the downside, but let’s be fair to the elderly who camped out in Central. Many of them were sold into the mini-bonds by ethically-challenged investment advisers at the banks who explicitly told them that the minibonds had the same risk profile as lower priced bonds. That crosses the line from caveat emptor to misleading or deceptive conduct, or at least negligence.