Was it really four years ago that we were in the grip of the great Article 23 debate, watching with wonder as the sharp-tongued then-Secretary for Security managed to upset nearly everyone, from taxi drivers to bankers, who may or may not have questioned her National Security Bill? Even strange tales of folk in Guangzhou boiling vinegar to ward off an unknown disease could not divert our attention.

Regina Ip is easier to ignore these days, and this is perhaps just as well, because she also seems to be making even less sense. The logic of her South China Morning Post column today seems to run thus… Singapore may soon overtake Hong Kong as the world’s freest economy. This doesn’t matter, because it’s just a title. Singapore scores highly despite having a dirigiste government and rigged court and political systems. Therefore Hong Kong should perhaps adopt the Singapore model.

The gangrenous-brained tangle of contradiction and non sequitur is best explained by Regina’s obsession with concluding that Hong Kong must shred what is left, 10 years after colonial rule ended, of its commitment to free markets and free enterprise in favour of central planning and state subsidy. The decline of non-interventionism since 1997 is the result of panicky, weak policymakers and grasping, over-powerful tycoons. By maintaining a high land price policy and protection of cartels, these forces have left much of our domestic economy distorted or stagnant. To compensate, the government decides to allocate resources to boost yesterday’s industries like the port, tourism and construction. Detractors demand that the government do the same for other sectors, like the long-dead manufacturing industry.

In the midst of such dim-wittedness and venality, people like Regina proposing public funding for futuristic sounding high-tech, space-age bio-whatever scams come out looking positively enlightened. The only public figure suggesting a return to neutral, less interventionist government is Alan Leong, whose ideas are of course totally ignored by the media. The Chief Executive election in which he is one of two candidates is in theory open to anyone to compete, but in practice the structure guarantees a particular winner. In the market place for ideas in today’s Hong Kong, the question for debate is – subsidies for industry A or subsidies for industry B? It’s like Park N Shop versus Wellcome. We never forget you have a choice.

James Tien, the intellectual gnome who leads the Liberal Party, demands a say in policymaking in return for his shabby and unprincipled gang’s votes for Donald Tsang in the forthcoming Chief Executive quasi-election. In theory, making the Executive Council less of a rubber stamp is a good idea – anything that loosens the grip of bureaucrats and their friends in the property and construction industries over policy formation should help. But the prospect of the Liberal nematodes having input into the executive decision-making process is frightening. Other than unadulterated self-interest and total contempt for the well-being of others, these slimebags are capable of nothing but shallowness. Past attempts by the Liberal Party to look like big important grown-ups and craft real policy are so laughably inept that I can’t resist entertaining myself by recalling some of them.

Miriam Lau, who represents taxi and minibus drivers, once stood up in the Legislative Council and demanded, for all practical purposes, that members of her constituency be given immunity from new, tougher laws against jumping red lights. In other words, she wanted it to be legal – or at least not very illegal – for minibus drivers to kill pedestrians. Whereas Tien is simply retarded, this woman is evil. This isn’t even funny, so I will return to the more amusing side of the Liberals.

My advice to Sir Bow-Tie would be to let these scoundrels cast blank ballots next month. If they dare – since they know full well that if they fail to support him a grim little man from the Hong Kong and Macau Affairs Office will come round with a hammer and break their fingers. That would be almost as funny to watch as James Tien producing a policy.

Wed, 28 Feb

The Hemlock Fund stopped putting fresh money into the stock market several months ago as the Hang Seng Index approached the 20,000 mark. Instead, I have been accumulating cash, including the Swiss Franc, Yen and a bit of Renminbi – the latter being a laborious affair, subject to a daily transaction limit (and even that is available only to Hong Kong residents). And I have been watching the herds. Middle-class citizens of Shanghai have been pawning their homes to raise funds to buy booming A shares, which rose over 100 percent last year. People in places like Hungary have been borrowing Yen at low interest rates to convert to their own currency to buy property. In the US, recklessness is coming home to roost as homebuyers are starting to default on their mortgages. All markets slid yesterday – 9 percent in China, 4 percent in New York, around 2 percent here and in London. Will retail investors be lining up to redeem their mutual funds today? The cold wind blowing through the streets of Central this morning whispers ‘contagion’.

So is this just a blip? Or are we in for a sharp 5 to 10 percent correction before resuming exuberance as usual? Or is this… the Big One, with years of excess liquidity, oblivion to risk and asset overvaluation imploding and the planet being plunged into a recessionary spiral? The contrarian bargain hunter in me is salivating at the prospect of the carry trade unraveling and a 20 percent across-the-board plunge in stocks, just as my inner schadenfreude aficionado eagerly anticipates smirks being wiped off faces.

Ten o’ clock, and Hong Kong opens nearly 4 percent down. Patience. There is no point in trying to catch a falling knife. The real buying opportunities come when the suicides start.

I wouldn’t say that...

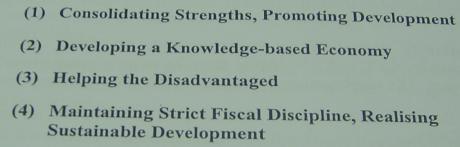

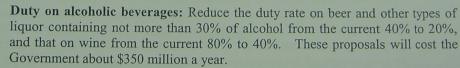

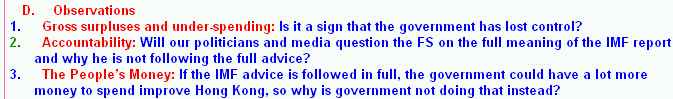

The real news story arising from yesterday’s budget is that the Hong Kong Government is deliberately accumulating an unnecessary share of its people’s wealth. It needs some reserves to back the currency we print. It needs some to smooth out expenditure if revenues fall. It could claim to need some in case of some cataclysmic disaster like a comet hitting us or evil speculators attacking our poor, innocent markets. But it does not need to sit on the best part of one year’s gross domestic product.

So incompetence doesn’t explain it. That only leaves some sort of mental or moral lapse. And I think I know what exactly it is. Since 1997, the decline in the quality of governance in Hong Kong has engendered hostility between rulers and ruled. Officials have become increasingly defensive, belligerent, remote and resentful of the dissatisfied population. And it has now come to the stage where the Government sees itself as an independent entity with specific interests of its own that are completely separate from those of the community known as ‘Hong Kong’. Indeed, it actually sees itself (and a few hangers-on) as being in competition with the community. In their diseased or malevolent minds, it is now ‘us’ versus ‘them’ – a zero-sum struggle between the bureaucracy and the people to see who can take the most off the other. It is not that they have lost control of the fiscal system. They have lost the whole idea of what a government is and what it’s for.

There is only one answer. Remember – the bits must be small enough for pigs to eat.

Last night’s debate between the two candidates for Chief Executive proved less tedious than expected, but also highlighted the fact that Hong Kong politics is missing something – politicians. In one corner was the man already picked to win the election, Donald Tsang, a lifelong bureaucrat who has never had anyone disagree with him in public and clearly found the whole event both unnerving and impertinent. In the other corner was the underdog, not to say lamb-to-the-slaughter, Alan Leong, who appeared happier and more confident – as he should, knowing that he will not be elected and therefore held accountable for anything he said. Thus, on the subject of democracy, Donald stuck to the usual blather about how it would be easy to implement provided certain, plentiful but somehow never precisely defined problems could be solved. Leong, on the other hand, cheerfully claimed that Beijing would say “Sure, Al, OK,” if asked nicely – such a barefaced, delusional falsehood that the audience he was addressing, watching on TV at home, might even have believed it.

As a barrister, Leong also had the advantage of debating experience. This was dismissed by Beijing loyalists as ‘clever words’ – an implicit admission that Tsang’s forensic skills are feeble, a lacking normally obscured by the uncompetitive nature of our political structure. When Leong mentioned that clean air would help Hong Kong compete as a business hub, statesman Tsang retorted that if that were so, the North and South Poles would have international financial centres. The charitable might attribute such idiocy to nerves, or a lame attempt at humour. Those who suspect Tsang genuinely thought he was dazzling everyone with his quick rapier-like wit can only pray.

The unprecedented forum, like the quasi-election itself, was off-limits to the general public, at the insistence of Donald. And we can see why. It wasn’t just because his wife thought he might catch something. Only members of the Election Committee, largely hand-picked to rubber-stamp Beijing’s choice come election day, were admitted. This gave the proceedings a slightly North Korean ambience, with nearly everyone applauding the dear leader’s comments with exaggerated enthusiasm. As entertainment, the show deserved about 4 out of 10. As a clash of political ideas it was lackluster, because there were no politicians. The only fierce expression of a strongly held belief based on a firm philosophy came in the form of an interruption in protest against the farcical nature of the ‘election’ from Long Hair – a Trotskyite. In one respect, however, the forum scored a clear 10 out of 10, and that is as a scary reminder that yes, we really are being run by lightweights.