22-28 March, 2009

Strolling into the local 7-Eleven, I tread on a cardboard box on the floor. Now empty, it used to contain 50 cigarette lighters and bears a warning about inflammable contents. I kick it aside and squeeze my way to the refrigerated cabinet at the back of the cramped store. Two girls – an 8-year-old with long red hair and a Victorian-style dress and her kid sister – have slid the fridge door open and are having great difficulty choosing which flavours of juice to get. “I’ll have strawberry, and you can have lemon,” the elder says, before changing her mind and decreeing that her pliant younger sibling will have lime.

“I already know what I want,” I announce as I gently slide the doors across so they, unavoidably but temporarily, bar the kids’ access to the shelves of beverages. The response is a pouting, haughty, and most of all malignant, stare from the strawberry fan with a hankering for citrus. Only after I take two cans of San Miguel out and considerately pull the door back for the young ladies, does her attention turn back to the great drinks debate.

As I get my change from the shop assistant, the pair arrive next to me and the senior, on tiptoes, places two brightly coloured bottles of pop on the counter. She looks up at me again, glaring with the juvenile human female’s unique hostility. She has a burning suspicion about me, and, unable to hold it in any longer, she spits it out. “Are you going to drink both of those yourself?”

As I look down, pondering words of chastisement on the evils of impertinence, I notice the empty cigarette lighter carton near her feet. A label on it says ‘Keep away from children’. I just taunt her with an I’m-a-grown-up-and-I-can-do-what-I-want smile and turn to leave.

A bracing, air-conditioned walk through IFC Mall this humid morning confronts me with the nameless public face of a hitherto unheard-of, world-famous brand called Alain Figaret. Most of the charismatic, resourceful little mammals that inhabit Hong Kong have important things to do and scuttle past oblivious to the poster in the shop window. Leading a more leisurely existence and being condemned by cruel nature to compulsively observe all that passes before me, I stop and stare.

Several questions come to mind. Why is someone so depraved-looking advertising men’s clothing? Some people’s appearance might prompt questions about sexual orientation, but this apparition is off the visible spectrum. Are we supposed to look at this display and think, “If I buy and wear this brand of clothes, I too can look like the sort of deviant who pays a prostitute to trample on a crucifix while he pleasures himself in unspeakable ways with small, helpless, furry woodland creatures?” And what else can that dangling hand, delicate but menacing, be poised to do but point out a victim for some devil-worshiping necrophiliac ritual?

And then, in the bottom left, is a clunky electric typewriter of the sort that once seemed futuristic, ushering in an era of free electricity, flying cars, family trips to the moon and robots doing the ironing. What part does it play in promoting this corporate image of nightmarish vileness? According to the website, this company has been ‘specialiste de la chemise depuis 1968’, which could serve as a clue but instead reminds us with a jolt – IFC Mall numbing us to clumsily foreign-sounding names – that this whole subliminal endeavour is intended to impart an air of indubitably Gallic provenance.

Abomination upon repugnance upon Europeanness. The only logical explanation is that the Alain Figaret marketing department is secretly working for Marks and Spencer.

The Standard’s ‘Mary Ma’ gets the morning off to a good start for fans of poor grammar and non-sequiturs…

Therefore, there have been periodic calls for establishment of a dedicated body to emulate Temasek or CIC in investing the SAR’s wealth.

- Hong Kong does not have a judiciary that acts as an arm of the executive branch like Singapore and the Mainland do, therefore…

- Hong Kong does not use simplified Chinese characters like Singapore and the Mainland do, therefore…

- Hong Kong does not have the death penalty like Singapore and the Mainland do, therefore…

- Hong Kong does not put tons of chili in its food like Singapore and the Mainland do, therefore…

- Hong Kong does not censor newspapers or ban demonstrations like Singapore and the Mainland do, therefore…

Hours of fun for all the family.

Why would we, or anyone, want ‘a sovereign wealth fund operating the way Singapore’s Temasek Holdings and the central government’s China Investment Corporation does’ – when the way they operate is to put billions of public money into investments at exactly the wrong time, thus throwing large amounts of taxpayers’ dollars down the toilet?

Temasek’s genius investments in the last couple of years include Merrill Lynch and Barclays before they collapsed, delivering paper losses in the billions (in any currency), and dozens of relatively minor stakes in obscure companies like the Australian kindergarten chain ABC Learning Centres, which lost the Lion City’s long-suffering citizens a mere US$270 million when it went bankrupt. In between times, it damaged relations with sensitive neighbouring countries through arrogant buying sprees.

China Investment Corporation was Beijing’s attempt to emulate this astoundingly brilliant Singaporean concept. Founded in 2007, just as Temasek was splurging on global financial stocks, it proudly, if somewhat hastily, bought holdings in the Blackstone private equity group and Morgan Stanley. CIC then spent several months strutting around looking very pleased with itself, as Western commentators dutifully foresaw the dragon, plus Russia and Abu Dhabi, buying up the entire USA. The Mainland’s xenophobes basked in national glory. But a year later, Blackstone’s shares had lost over 70% of their value, and Morgan Stanley tanked. As with Temasek, the result was paper losses in the billions and highly unimpressed citizens.

It is hard to believe that anyone is seriously considering turning part of our relatively conservatively managed reserves into a Temasek/CIC type of fund, in which smug, jumped-up civil servants eschew due diligence and gamble other people’s wealth away using a sort of reverse-value-investor strategy that uncannily identifies tomorrow’s penny stocks as they peak in price. (‘Dumb money’, as Warren Buffett called it.) But that was what some of us thought when officials said they might put taxpayers’ billions into a Disney Land so small that Snow White can only fit three dwarves in it.

The Australian Government causes a stir by updating its travel advisory on our fair city to warn that “levels of air pollution in Hong Kong may aggravate bronchial, sinus or asthma conditions.” Could the officials in Canberra be making a small but helpful contribution towards solving one of the Big Lychee’s most pressing problems? It is true that the number of visitors we receive from Down Under is relatively small. It is also true that they are a hardy breed who grapple with giant wombats and dingoes on a daily basis and are unlikely to be deterred by a few suspended particulates penetrating their lung sacs and causing irreparable respiratory damage. But word gets around, and if our antipodean friends or the media pass on the news to enough people, maybe even Mainlanders – the majority of travelers entering Hong Kong – will stop coming here. By sweet good fortune, the eradication of the great tourist menace would also reduce the number of busses clogging up our streets and therefore clean our air too!

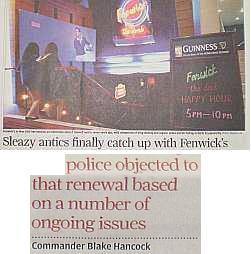

The almost-traumatized look on his face makes it clear that this goes beyond Hong Kong’s most inebriated weekend of the year. The bottom – the very deepest nadir – will fall out of Odell’s life if this place closes. Theoretically a Wanchai nightclub or disco, Fenwicks after midnight is a living catacomb where Hong Kong’s most desperate, dispirited and shameless human dregs, plus some zoological near-misses, congregate.

I try to make him feel better by reminding him that this is an old rumour. No amount of coke busts, illegal-immigrant round-ups, overdosed businessmen and Australian Foreign Affairs Department advisories will ever close Fenwicks. The only thing that could kill the place off would be a huge drop in tourist numbers. Life will be wonderful, either way.

‘A number of ongoing issues’ have indeed led the Hong Kong Police to oppose licence renewal at Fenwicks, the South China Morning Post reports. Some time in the early hours of tomorrow the seedy subterranean sleaze-hole will for the last time disgorge its crowd of drunken, ageing, male business travellers and the drug-dealing South American hookers they are pawing onto the streets of Wanchai. Had there been more warning, the Antiquities Advisory Board would have been able to consider the importance of the place to the community’s collective, if hazy, memory and declare the premises a Grade 1 heritage site for future generations to enjoy. Thankfully, however, the sordid dive is history in a more literal sense, and will no longer play its distasteful and grubby role in attracting teeming hordes of undesirables to our shores.

That leaves Disney Land, the expansion of which is subject to ongoing wrangling between the avaricious Mouse, demanding yet more billions of taxpayers’ wealth, and uncharacteristically gutsy officials standing their ground – inspired, no doubt, by the valiant example of Commander Blake Hancock and the courageous young men of his District Intoxicated Gwailo Control Unit. After tossing a few laid-off workers around to attract attention, the rapacious Rodent is dropping dark hints that it will be opening a vastly bigger and better facility in Shanghai-the-city-that-will-take-over-from-Hong Kong. I see a major opportunity here for not just a win-win, but a win-win-win. We can simultaneously 1) relieve the Big Lychee of the serious financial burden known as the Magic Kingdom, 2) free ourselves of the millions of tourists who crowd us out of our streets, sidewalks and buildings, and 3) start to give our hard-working people proper homes.

This will involve telling Disney to pack up their plastic castles and cartoon character heads and take the lot up to Shanghai. As Oliver Cromwell put it, “I command ye therefore, upon the peril of your lives, to depart immediately out of this place; go, get you out! Make haste! Ye venal slaves be gone! So! Take away that shining bauble there, and lock up the doors. In the name of God, go!”

With both the money-grasping theme park and its millions of fans out of our way, we will be left with a piece of land that even before planned extra reclamation, if laid upon Tsimshatsui, would stretch from Kowloon Park to Boundary Street. You could fit 10 Discovery Bays in there – a green, quiet, car-free city of 150,000-200,000 complete with rail line, offering affordable, spacious apartments for the sort of creative, talented folk the Government says it wants but refuses to offer a decent quality of life.

But I am running ahead of myself. First we have to burn Disney Land down and collect the insurance – or at least find some way of closing it. Any chance of getting hold of ‘a number of ongoing issues’?

It would be understating the case to say that this will be an unparalleled achievement for the Chinese people. What other country in the world could create a core of global capital, debt, securities, futures, forex and other markets in a place that does not have a freely convertible currency, a dependable legal system, serious accounting standards, a free flow of information or a critical mass of loud, tall lawyers, bankers, traders and fund managers who stroll around purposefully in suits and drink too much – let alone taxi drivers who can discuss over-the-counter derivatives in halfway decent English?

Inevitably, doubters and skeptics are saying it can’t be done, and the whole announcement was just a pat on the head for Shanghai’s leaders, whose self-esteem has taken a bit of a battering with Beijing getting the Olympics and Tianjin asking central planners to grant it its own special role as a location for financial services. Our very own Financial Secretary, John Tsang, shrugs off the idea politely with even more vacuous-than-usual blather about proactively complementing the former Pearl of the Orient – letting it be the national hub for monorails and bad architecture sinking into swampland, perhaps.

But others see this as the final warning for the Big Lychee’s wayward and infantile population, constantly complaining – even as global trade and investment falls off the cliff – that their unelected leaders deliver less-than-perfect standards of governance. Sing Tao Chairman Charles Ho used the occasion of his newspaper’s exciting Leader of the Year Award last night to warn that Hong Kong will decline into rubble if its outspoken and dissatisfied people don’t get smart and ‘Focus On The Economy’, as shutting up about cretinous policymaking is known in such circles. Former Chief Secretary Rafael Hui, helping to dish out the prizes to the winners, added that we will all end up speaking in the idiotic-sounding dialect of the Yangtze River Delta if we’re not careful.

(Reminder – write to Rafael and tell him ‘Charles Ho is Shanghainese, you ass’.)

The proof that Hong Kong is doomed can be seen in the Leader of the Year Awards themselves. In the past, the recipients have been truly famous, high-class and elite – either born into rich and influential families, or making up for not doing so through frenzied shoe-shining. Thus past years’ winners included Tung Chee-hwa (Shanghainese) (twice!), Hopewell Holdings tycoon Gordon Wu, Stock Exchange Chairman Charles Lee, Bank of East Asia boss David Li, Lan Kwai Fong maestro Allen Zeman, Chief Government Cheerleader Ronald Arculli and patriotic legislator Rita Fan (Shanghainese). This year, it’s barrel-scraping time, with awards going to obscure nonentity losers who do scientific research and help AIDS orphans on the Mainland. It’s downhill all the way from now on.

stores

Dymocks, IFC Mall

& other HK Dymocks

(some, probably, maybe)

online

Hong Kong & worldwide

USA & worldwide

UK

Canada

Germany

Japan

France