Some Friday links…

An argument that China’s shift to greater domestic authoritarianism and overseas aggression pre-dates the arrival of Xi Jinping as leader, with a summary here if you’re short of time. This is partly not news (renewed Internet and other clampdowns started under Hu Jintao). To the extent the argument holds water, it implies that the new nastiness of the regime is part of a longer-term plan backed by most of the CCP elite,  which is more worrying than the idea that it is the whim of one messianic Mao-nostalgic strong man. It also requires us to assume that the Communist Party draws up and follows multi-generational epic strategy, rather than form policy through infighting and making-it-up-as-they-go.

which is more worrying than the idea that it is the whim of one messianic Mao-nostalgic strong man. It also requires us to assume that the Communist Party draws up and follows multi-generational epic strategy, rather than form policy through infighting and making-it-up-as-they-go.

If there is a grand plan, China’s younger generation aren’t on board. Here’s how the CCP is engaged in a new anti-Japanese war, battling for the hearts and minds of the nation’s youth against explicit gay-themed ‘slash’ manga booklets and Doraemon (and apparently losing).

China’s latest GDP figures, and other data that don’t add up.

On local matters, why Hong Kong’s stock market goes through those weird mini-crashes.

I declare the weekend open with a little tale about Rich People’s Problems.

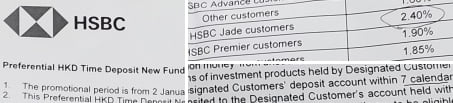

As a Jade (‘bespoke lifestyle services’) HSBC customer, I get exclusive mailings offering loans for moderately sizable sums of money. They would know, if they checked, that I have no use for these, as I am already sitting on quite a lot of cash in my savings account.

(Professional financial advisors would loudly protest that you should not hold this much cash. They say ‘You must keep your wealth working’, and ‘You cannot time markets’, by which they mean ‘I am not making any commission’. In reality, it depends whether you prioritize capital appreciation or preservation, which will change over time. And while no-one has a crystal ball, most of us can see whether, after a decade of central-bank money-printing, asset prices have more upside or downside right now.)

HSBC is also offering Jade customers a chance to put cash on time-deposit at an annual rate of 2.4%. This sounds attractive. But they did not send me an exclusive mailing advising me of this – I read about it in a newspaper story about local interest rates. Armed with the clipping, I went to the Luxury Customer-Service Palace, snatched some free Mentos mints, and sat down with a client-relations floozie.

She knew of this promotion. But, she made clear, I could not simply move the cash over from my savings account – it had to be ‘new funds’, transferred in from outside HSBC.

I did some cursory eye-rolling and spluttering for effect, but basically took the bad news like a man. It made sense. Sounded a bit too good to be true. The newspaper article obviously wouldn’t mention the small print. So I shrugged, said thanks and made to leave.

“No!” she said, leaning across the desk and clutching my wrist*. “You can still do it.”

She explained that if I transferred the money from my savings account to another bank and left it there for more than seven calendar days, I could transfer it back – and it would count as ‘new funds’.

I gave her an impassive hard stare. The offer expires at end-January, which was nine calendar days away. I do have an account at another local bank, but not with on-line access. I pictured endless form-filling against a running clock, and inevitably some sort of delay – maybe impertinent questions from some transaction-screening compliance officer. I would think about it. Grabbed more mints on the way out.

I gave her an impassive hard stare. The offer expires at end-January, which was nine calendar days away. I do have an account at another local bank, but not with on-line access. I pictured endless form-filling against a running clock, and inevitably some sort of delay – maybe impertinent questions from some transaction-screening compliance officer. I would think about it. Grabbed more mints on the way out.

After less than 48 hours of the prevarication that comes so naturally to me, the whole thing became unfeasible, and the issue went blissfully away.

But anyway, here’s to HSBC – the bank that attracts new funds by telling you to move your cash to another bank.

*OK, so she didn’t clutch my wrist.

Classic case of conflict of interests you got at HSBC. It’s the same in retail where some clerks suggest you to get a refund and make a new purchase instead of simply making an exchange in stores. But that’s small fish really.

More worrying is that SFC and ICAC have gone MIA, the former still investigating cases from last decade and the latter focusing on mainlanders slipping a 500 HKD bill in their passport/bankbook/etc (as if it wouldn’t become standard practice before 2047).

That crash on Jiayuan is just trolling the regulators (chairman starts dumping its stake in the morning, says “not aware of anything material” in the afternoon, proceeds to dump more the following day, now the share will probably be suspended until it is delisted just like Hsin Chong and the board will get a “reprimend” or a “censure” in 10 years).

Oh and by the way,

“maybe impertinent questions from some transaction-screening compliance officer”

C’mon, you should know better, “Best of all, It’s in Hong Kong” applies to laundering

Another case of small fish.

Peoople were distrustful, unwilling to deposit cash through ATMs.

Some years ago, HSBC had a promotion: for a period, anyone who deposited cash through an ATM would be entered into a Lucky Draw.

I imagined people withdrawing cash one day, and cannily putting it back the next.

There’s something magical about a pert female in a suit who is wearing uncomfortable, toe-pointy footwear clutching ones’ wrist. Marvelous.

You even get better rates at HSBC if your money comes from drug related business, maybe you should have inquired more thoroughly.

So, what interest could she offer without the multiple money transfer? Might have been worthwhile anyway, no?