People bought multiple units at the token ‘Hong Kong Property for Hong Kong People’ housing development at Kai Tak (including an official at China’s local Liaison Office). This makes a mockery of the supposed intention of the project – but so do the high prices, anyway. A modest amount of mouth-frothing ensues.

People bought multiple units at the token ‘Hong Kong Property for Hong Kong People’ housing development at Kai Tak (including an official at China’s local Liaison Office). This makes a mockery of the supposed intention of the project – but so do the high prices, anyway. A modest amount of mouth-frothing ensues.

In beautiful downtown exotic Tsuen Wan, a developer is offering new (well, half-built) one-bedroom apartments for HK$10 million each. A real-estate agent, who has an interest in selling the things, estimates a rental yield of 2.2-2.4% (half the dividend yield of, say, HSBC shares). Down in Sham Shui Po, a family of three paid HK$200 million for nine apartments at another new development. At least, this is what the developers want us to believe – they are not above exaggerating sales volume, demand and prices, even by arranging fictitious transactions.

Over in sunny Soho, just up the hill from the Central Business District on Hong Kong Island, the tables are turned.

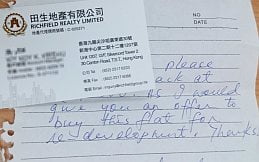

Here is the story so far. Late last year, I moved out of my aging, crumbling tong lau home of 25 years and rented a place nearby. The plan was to sell to an end-user or landlord – ‘rare’ old places next to the Mid-Levels Escalator are in demand. And then an assertive lady from Richfield, the (allegedly) disreputable buyers of slums for redevelopment, knocked on the door, airily offering HK$21,000 a square foot. This is a good 25% more than the going rate for these places. I said I would think about it.

As promised, the Richfield floozy got back in touch after Chinese New Year, mentioned her earlier offer (now mysteriously trimmed to HK$20,000) and asked me eagerly for my ‘counter-offer’. I took this as an invitation to up the price. After making her sweat for a few days, I put on my best casual ‘take it or leave it’ voice and told her I’d accept HK$24,000. Her response was “Wah – you are not greedy!” followed by much moaning about my grasping octogenarian neighbours who (bless them) are demanding HK$30,000 or more.

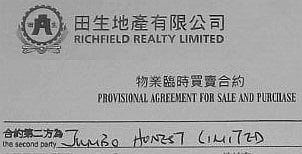

After consulting with her boss, she came back with an offer of HK$23,999.99 – or something microscopically less than I had asked. Maybe a face-gaining thing, or perhaps that’s how she makes her commission. She instantly emailed me a ‘provisional agreement for sale and purchase’ and badgered me about signing.

Some of us would get tough and insist on another 5% out of these unscrupulous rogues. (It’s not the principle – it’s the money!) Bearing in mind Carrie Lam’s advice to pocket it first, I am happy enough. I would make a terrible real-estate mogul. Mindful of the fact that these people are slime (the paperwork is in the name of a company called ‘Jumbo Honest’), I have tossed the whole thing over to my lawyer. He says it all seems OK.

I’ll rent for now and hope for a property correction-crash-bloodbath. Still, a quick search shows that the proceeds from the Soho hovel are more than enough to buy a larger, newer place in many decent districts – on the secondary market. That doesn’t mean such homes are widely affordable; Richfield’s offer is equivalent to eight times what I originally paid for my place in the early 90s, which is probably roughly in line with property-price rises in Hong Kong over that time. But it does suggest that the new projects in Kai Tak, Tsuen Wan, Sham Shui Po, etc are unreal, figuratively or literally.

You should have stipulated only either mainland tu haos or South Koreans could purchase your flat.

That’d stir the HK for HKers hornet’s nest…

Only in Hong Kong would a 400 sqft flat in a shithole like Tsuen Wan be lauded as a spacious and luxury living environment for the wealthy!

Oh dear. Your 1001h piece about concrete boxes people call property. So sorry for you and for us.

Here’s a tip to bring some jollity into your life. Just stop reading the SCMP. Do as I do and have a good laugh at the headlines. You wouldn’t have wanted to look under Tommy Coooper’s fez, would you? The Post is similar. Take it at face value, look at the headlines and read no further.

My favourites today are:

CARRIE LAM AMONG THOSE AT MASS FOR JAILED FORMER HONG KONG LEADER

EDUCATION DOESNT NEED MORE MONEY, IT NEEDS LESS

BEIJING AGREES CARRIE LAM CAN RUN THINGS HER WAY AS LEADER

Just lie back, roll those ideas round your head and enjoy!

One commnetator, I cannot remember who, has a bee in his/her bonnet about domination of HK by the “Baptists”. Given last night’s special mass for Donald Tsang, apparently attended by several hundred, including many of the (alleged) great and the good, including the incoming CE, may we have a column and comments on matters arising therefrom.

If you are selling your old flat for approx 8 times what you paid for it in the early 90’s then you are definitely doing Richfield’s ultimate client a favour, given they are buying for redevelopment.

Why not stick to solidarity with your neighbours who have probably lived there most of their lives?

Congratulations on (a) blowing George’s gasket and (b) taking your winnings. How big was the flat? About $15-17 m worth, I guess.

As you concede, this could be on the cheap side. But one ha s to balance peace of mind against the possibility of greater gain.

In your position, I would consider buying a 700 sq ft flat in the sticks for about $4-5 m. True you might lose half of the money, but it could be better than being moved out every year or two.

I must remind you, that told all of HK gleefully of the folly of buying CentreStage at HK$6,500 per sq/ft…

Now at HK$17,000 per sq/ft

If I had your pile of loot, at your age, I would make a beeline for Margaritaville and drink myself into oblivion, since that is going to happen anyway, sooner or later. So why wait ? It’s either that or slipping into dementia and ending up in a bunkbed at the China Coast Community, just like Ted Thomas.

I know what I would do.

Well, Hemmers, all l can say is that having profitted so handsomely from the property racket which you have always been at such pains to condemn, you should now trouser your loot and bugger off somewhere heaps nicer.

Don’t get me wrong. I don’t want to lose you, but l just don’t see what more you have to gain from being here. Why not go and spend your twilight years surrounded by smiling, dusky handmaidens (or twinks, if you share the good “Doctor’s” proclivities) and watch the sun set over a sparkling sea?

As Joe Blow rightly points out, the Ted Thomas alternative is hardly appealing, and you can still blog away like billy-o about the myriad enormities of Hongkers without having to experience them first hand.

Bon voyage, old cock!

…living on spongecake……put juice in the blender….wasting away in Margaritaville

Sometimes I wished I was Keith Richard.

https://www.youtube.com/watch?v=SXfMkJ17Qys

http://www.scmp.com/news/hong-kong/politics/article/2083248/carrie-lam-among-those-mass-jailed-former-hong-kong-leader

Dimuendo, not last night, but several days earlier. Everyone, probably including the Bishops & a Cardinal, were praying Donald keeps his mouth shut. And he will, he’s a good boy.

One would think that cult’s cathedral would never have time for a regular service if it’s running a mass for every convict… Oh, that right, Jesus said “blessed are the rich and powerful, for the church will sell them the keys to the kingdom of heaven”, or some other fraud. https://en.wikipedia.org/wiki/Indulgence

My bad on the date.