It’s not as if 25 basis points is going to make a detectable difference to anything in reality, but Janet ‘accommodative’ Yellen just has to drag this out for at least a few months more. Still time for Hong Kong property developers to rope a few more suckers in…

Yes, you still have to sleep on the sofa until 2018.

Zero interest rates are supposed to encourage borrowing, and thus help the world recover from the financial crisis of 2008, which itself was caused by overly low interest rates and too much borrowing. The alternative is to instill financial rectitude by making borrowing painful – a system that served humanity well for thousands of years but seems just too much like hard work in today’s world.

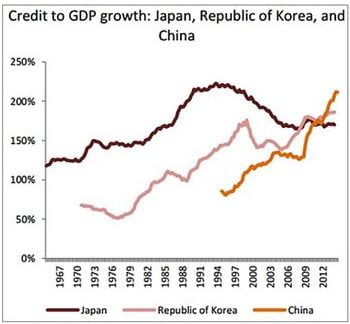

Unusual economic events make for pretty strange charts. Here is a fairly normal one, showing how borrowing increased in three Asian countries as they developed over the years. It’s an easy graph, with the y axis showing credit as a percentage of GDP and the x axis showing time…

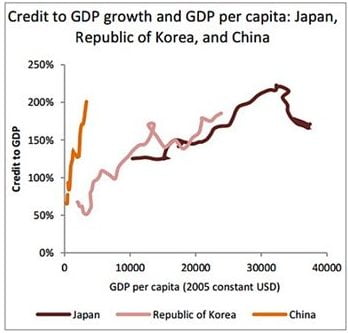

This is a weirder one. It shows the same thing but over the course of rises and falls in GDP per capita. It does not show time in the form of years, but you can spot events as lines go backwards or loop round. The Japan line’s reversals in direction show economic contractions that took place in (I think) the mid-70s, the late 90s, early 2000s and in the last few years, when the figure falls from around US$38,000 to US$35,000. The Korean line does a neat loop, which would have been the country’s sharp contraction around 2009, since when per-capita GDP has gone from approx. US$14,000 to over US$20,000…

And yes, China has reached roughly similar levels of credit-to-GDP before barely hitting per-capita GDP of US$5,000. I declare the weekend open with the comforting hope that it probably doesn’t matter and will surely sort itself out.

Nice one.

The first graph doesn’t show “… GDP growth”, but rather “credit/GDP” or “credit as %age of GDP”.

China’s propaganda department seems to fool most of the world’s media all the time, since “2nd biggest economy” seem obligatory these days. But, as the 2nd chart shows, GDP per head is actually about an eighth of Japan’s.

Have a great weekend!

The inequality issue also has a lot to do with how the interest rate movements will fall out over the economy. Japan’s inequality is much lower than China’s, both money and debit in far fewer hands means China is less stable and less predictable. Defaults among the middle class are seldom anywhere close to total write-offs, where as Wall Street has shown, high end debt is high risk.

The Fed’s decision not to raise rates for now has everything to do with Xi’s State visit. Read the statement by the Head Munchkin. If the Fed had raised rates (even by tiny baby steps) would crash emerging markets but more specifically China. What does this tell us?

Maybe the Conduit of Power should amp up his juice so his RE developer buddies can unload their properties (no interest loans buy! buy! buy!). A Kamikaze approach before the fall.

Caveat Emptor.

My reaction to the charts was in a similar direction as Nimby’s in that China is a big population and there is still a tremendous amount of dead weight in its economy. GDP/capita is spread over a lot of farmers while I suppose that most of the GDP is being generated by the klepto class and those people whose output has been rapidly multiplying due to more efficient technology and capital formation. The other two examples had a much more even development so perhaps GDP/capita is a more interesting comparison for them. It would be interesting to see the second chart with something more like top quartile income/top quartile population on the x-axis. With that said, the growth in Credit/GDP is still alarming.

There will be much gnashing of teeth in HK, NYC, & London when the time comes to attempt to extract anything that can be saved from bad loans and investments.

The CCP will simply walk away with whats left, knowing how greed effects collective memory.

http://onforb.es/1Qk0md9